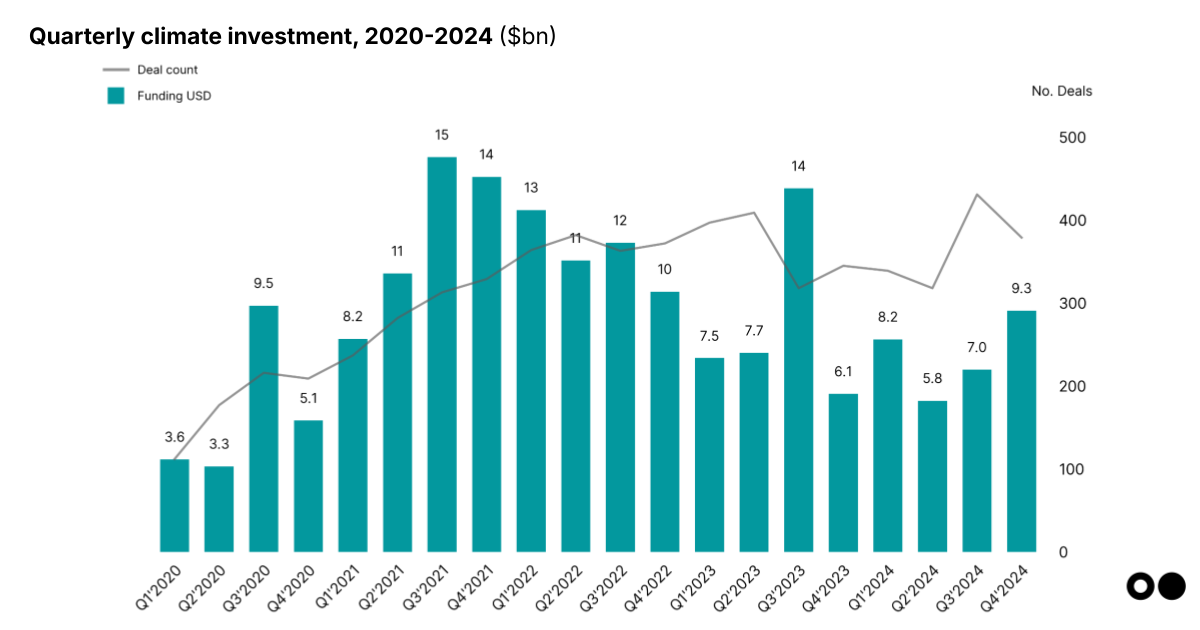

Climate tech investment trends 2024: $30 billion and a 14% drop as the market finds its new normal

The global climate tech market has entered a new phase — well, back to a return to an older phase. After years of rapid growth from 2020-2022, and a 24% drop in 2023, 2024 marked a 14% decline in total climate tech venture and growth investment, reaching $30 billion across 1,460 deals. The boom is over, but what's left is not a bust, but a reset.

Despite macro headwinds — from high interest rates to delayed IRA rollouts to geopolitical instability — the sector continues to mature. Investors and capital are becoming more selective and efficient. The market is recalibrating, and the investors who stay the course will shape the infrastructure, energy, and industrial systems of the next decade as the transition continues on.

📊 Sightline Climate continues to track these shifts, offering the tactical data and insights investors need to make confident decisions. Our complete dataset and full report is here: Download the 2024 Climate Tech Investment Trends Report.

This report has funding and deals data by vertical, stage, product type, and more. Sightline also have a whole other layer of analysis just for clients. They can access the full report and underlying data pack, with complete data and analysis of 2024 climate investments across graduation rates, sectors, ‘first-of-a-kinds’, exits, investors, geography and product type via the platform here.

If you’re interested in becoming a client, request a demo here.

But read below for more takeaways.

A snapshot of 2024: the numbers behind the new normal

- 💰 Total investment: $30 billion in 2024, down 14% YoY

- 🤝 Deal count: Nearly flat — 1,460 vs. 1,468 in 2023

- 📉 Growth-stage funding: Down 38%, from $11 billion to $6.7 billion

- 📈 Seed funding: Up 3%, showing early-stage resilience

- ⚡ Top sector: Energy, up 12% to $9.4 billion

- 🚗 Biggest drop: Transportation, down 36%

- 🧾 Repeat investors: 12% fewer investors overall, but climate specialists dominate

The data suggests the market is recalibrating, rather than contracting.

From boom to balance: climate VC’s maturing phase

.png)

While 2021–2022 brought record-breaking capital inflows, the 2024 slowdown reveals a sector finding its footing. The compounded annual growth rate (CAGR) dropped from 135% (2020–2022) to 25% (2022–2024) — a clear sign of maturity.

Yet, optimism remains. AI-driven clean power solutions, Europe’s strengthened carbon markets, and rising demand from emerging economies all fueled new investment momentum. Investors increasingly see climate infrastructure as infrastructure, not as niche.

Sector spotlight: Energy leads, Transport lags

.png)

Energy: the comeback sector

Energy saw a 12% rise to $9.4 billion, with nuclear and storage leading the charge. After declining to 19% of total energy investment in 2023, nuclear and storage rebounded to 38% in 2024.

Top deals included X-energy, Zap Energy, and Form Energy, underscoring a return to firm power and grid resilience.

Transportation: batteries run out of charge

Transportation faced a steep 36% drop, driven by a 79% fall in battery investment. While auto investments remained relatively stable (down just 2%), several high-profile bankruptcies — including Northvolt and Fisker — dampened confidence.

Stage breakdown: Growth falls, Early-stage holds

.png)

Growth investment down 38%

Large growth-stage rounds — once the market’s backbone — dropped sharply from $11B to $6.7B, reducing overall totals. Yet deal counts rose by 20%, showing that smaller, bridge-style deals are keeping companies afloat.

Early-stage resilience

Seed and Series A investments stabilized. Seed was up 3%, while Series A fell just 8%, signaling that early-stage innovation remains attractive to long-term investors.

Geography and investors: specialists take the lead

Repeat investors now make up the majority of climate tech backers. Specialist funds dominated every stage, especially in Carbon (37%) and Energy verticals.

Conversely, generalist investors have retreated, suggesting that climate investing is professionalizing — a sign of sector maturity.

Exit activity: acquisitions drive a record year

.png)

2024 saw exits more than double (+136%), led by acquisitions (92% of total exits). IPOs ticked up slightly, while SPACs continued to fade, now just 5% of exits versus 49% in 2021.

Oil and gas majors led a buying spree, acquiring climate tech firms to accelerate their own transition — though some analysts warn this could be “the feast before the famine.”

Macro trends shaping 2025

- Interest rate clarity is restoring investor confidence.

- AI and data centers are driving clean power innovation.

- Emerging markets — especially India — are producing significant IPOs.

- Climate tech infrastructure is increasingly viewed as a mainstream asset class.

Sightline Climate co-founders Kim Zou and Mark Taylor unpacked these shifts in an exclusive webinar on January 23, alongside a deep dive into the Climate Capital Stack Report. You can watch the webinar here.

Download the full report: data, insights, and sector deep dives

The 2024 Climate Tech Investment Trends Report is Sightline Climate’s most comprehensive annual data set yet — covering:

✅ Funding by stage, sector, and product type

✅ Graduation rates and exit trends

✅ ‘First-of-a-kind’ project investments

✅ Investor behavior and geographic shifts

📊 Download the report now to access 250+ data points, charts, and proprietary insights 👉 The 2024 Climate Tech Investment Trends Report

FAQs: climate tech investment trends 2024

1. What is the total value of climate tech investment in 2024?

Total venture and growth investment reached $30 billion, down 14% from 2023.

2. Which climate tech sector performed best in 2024?

The Energy sector led, rising 12% to $9.4 billion, driven by nuclear and energy storage projects.

3. What caused the drop in climate tech funding?

High interest rates, slower policy rollouts, and investor caution all contributed to the market’s cooling.

4. Are early-stage climate startups still being funded?

Yes — seed funding rose 3%, showing continued support for early innovation.

5. Who are the most active investors in 2024?

Specialist climate funds dominated, while generalist investors have largely exited the space.

.svg)

.png)